The Surge of Connected TV

Connected TV (CTV) is transforming how Canadians consume content, reshaping the media landscape in ways that at one time would have been unfathomable. CTV refers to smart television sets that can connect to the internet, allowing users to access a plethora of content beyond traditional linear broadcasts. This also includes streaming digital online platforms such as Netflix, Crave, YouTube and Disney+. As more Canadians explore digital platforms, CTV continues to experience remarkable growth, with over two-thirds of adults in Canada now engaging with CTV. This shift reflects a broader change in both consumer behaviour and advertising dynamics, though it complements rather than replaces.

Data Insights: The Canadian Landscape

The Rise of CTV Viewership

Recent studies report that time spent with CTV will have increased almost 50% between 2020 and 2025. By 2025, it will reach 1 hour and 29 minutes (1:29), a gain of nearly half an hour over a five-year period. TV time will drop by the exact same margin, showing the direct displacement CTV viewership has on traditional TV. Time spent with CTV by Canadian viewers is eating into linear TV time underscoring that an overall TV time spent growth (including linear TV and CTV) in Canada is almost flat, staying just above 4 hours daily for the remainder of our forecast period. What’s changing is CTV’s share of time: In 2023, it will account for 33.2% of overall TV time spent. CTV’s share is expected to be laced with poised growth, as viewership persistently migrates from traditional linear TV to OTT streaming services like Netflix and platforms like YouTube.

Maximizing Impact: Harnessing the Power of Both Linear TV and Connected TV

CTV’s accessibility through smart TVs and connected devices, like Roku, Apple TV or Amazon Fire Stick, has played a significant role in its rise. Millennials and Gen Z are particularly drawn to CTV, thanks to the flexibility and personalized content it offers, making it a critical platform for brands targeting these demographics. However, this doesn’t spell the end for linear TV. In fact, linear TV remains a powerful platform for advertisers, especially when it comes to reaching broad, older audiences who continue to prefer traditional viewing habits. Live sports broadcasts, political debates, and breaking news programs still draw millions of viewers. For example, in 2023, major events like the Super Bowl, FIFA World Cup and Canadian elections attracted significant audiences on linear TV, proving its continued relevance.

To achieve the greatest impact, media advertisers should adopt cohesive and coordinated strategies that leverage both linear TV and Connected TV (CTV). Rather than viewing CTV as a replacement for linear TV, brands can harness the strengths of both mediums to maximize reach and engagement. Linear TV continues to offer unparalleled mass reach, especially during live events, news broadcasts and special programming, making it an ideal medium for building widespread brand awareness. By strategically placing ads during high-impact programs, advertisers can capture broad audience attention. Simultaneously, CTV provides the precision of digital targeting, allowing brands to reach specific demographics, interests and behaviours with customized messaging. This dual approach allows advertisers to engage consumers at both a broad and individual level.

For media advertisers with budget constraints, CTV offers an affordable entry into television advertising without sacrificing impact. While linear TV can require significant investment, CTV provides flexibility in spending with lower barriers to entry. Small- to mid-sized brands can benefit from CTV’s ability to target niche audiences more precisely, ensuring their message resonates with the right consumer groups. Moreover, CTV’s data-driven nature enables real-time insights into viewer behaviour, allowing advertisers to adjust their campaigns dynamically. CTV’s capability to track key metrics such as click-through rates, viewer engagement, and purchase intent also makes it an ideal platform for e-commerce integration. For instance, interactive ads on CTV can direct users to product pages, driving immediate sales and conversions.

The Biggest Players in Canada: A Competitive Landscape

Several key players are shaping the advertising horizon in the Canadian CTV market. Streaming platforms such as Netflix, YouTube, and Crave dominate the scene, each one offering exceptionally unique advertising opportunities.

- Netflix: While traditionally ad-free, Netflix has introduced an ad-supported tier, expanding its potential for ad revenue and increasing accessibility for viewers significantly. This move has carved a notable shift in their business model, allowing advertisers to reach millions of engaged viewers at the same time.

- YouTube: As a digital video advertising ‘trailblazer’, YouTube remains an instrumental player in the CTV space. Its widely extensive reach and diverse audience demographics make it a prime target for brands looking to leverage video content for advertising.

- Crave: Crave offers premium content from HBO, Showtime, and exclusive Canadian productions. With its ad-supported tier, Crave provides advertisers access to a high-quality, engaged audience, making it ideal for brands looking to advertise in a premium, less cluttered environment.

Advertising Spend Shift

The advertising landscape is also adapting to CTV migration. Recent data suggest that 40% of US marketing professionals have started reallocating funds from linear TV to CTV, and similar trends are also evident in Canada. With CTV ad spending expected to grow by nearly 18.8% this year, it is only crucial for advertisers to embrace this change wholeheartedly. Traditional TV advertising is projected to grow by a mere 0.7% in the same period, essentially buoyed by major events such as the Summer Olympics and elections.

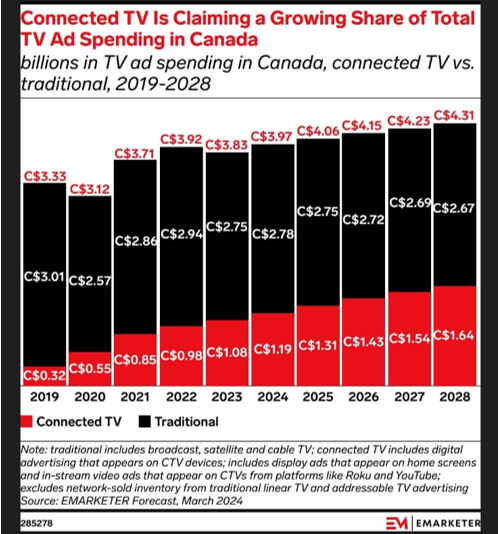

Additionally, Connected TV is claiming a rising share of total TV ad spending in Canada. The ad spending for CTV has shown a remarkable growth, from C$0.32 billion in 2019 to an estimated C$1.08 billion in 2023. The forecast shows continued growth for CTV, with projected ad spending increasing to C$1.19 billion in 2024 and C$1.64 billion by 2028. In contrast, traditional television ad spending is expected to see a snail pace rate of growth, moving from C$2.75 billion in 2023 to only C$2.67 billion by 2028.

A Data-Driven Shift in Advertising Spend

This transition is not just about reallocating budgets; it’s about welcoming a new era of data-driven advertising. CTV offers premium targeting capabilities, enabling brands to reach fragmented audiences with tailored messaging. The astuteness of measuring performance in real-time allows marketers to optimize their strategies efficaciously, resulting in a higher return on investment (ROI).

Driving Instant Sales: The Power of e-commerce Through CTV Ads

Connected TV (CTV) has revolutionized the potential for e-commerce by offering advertisers the ability to drive immediate sales directly through TV ads. Unlike traditional linear TV, CTV ads are interactive and often come with built-in features that allow viewers to engage with the content instantly. For example, viewers can click on shoppable ads or scan QR codes displayed on-screen, leading them directly to product pages or promotional offers. This seamless integration between advertising and e-commerce enables brands to capitalize on impulse buying behaviours while providing a streamlined path from awareness to purchase. As a result, CTV not only boosts brand visibility but also facilitates measurable, real-time transactions, making it an essential platform for marketers looking to convert TV ad exposure into immediate sales.

Peloton’s Perspective

Peloton believes that CTV is not merely a passing trend; it is a fundamental shift in how Canadians consume media and how brands engage with audiences. As viewership continues to transition from traditional television to CTV, advertisers must embrace this change to remain competitive and relevant in an increasingly digital world.

The rise of CTV represents nothing but a profound evolution in media advertising, characterized by enhanced targeting capabilities, real-time analytics and a diverse range of platforms. Brands that prioritize CTV in their marketing strategies will not only reach fragmented audiences effortlessly but will also capitalize on the growing trend toward digital consumption. As we gradually move forward, it is evident that CTV will play a central role in structuring the future of advertising in Canada, making it imperative for brands to invest in this dynamic medium now.

CTV is undoubtedly laced with immense advertising potential. Contact Peloton to discuss how it can benefit your advertising strategies .

Sources-

- EMARKETER Forecasts on Canadian CTV ad spending and viewership.

- Interactive Advertising Bureau (IAB) and Advertiser Perceptions.

- Recent reports on Canadian digital video consumption and trends in advertising.

- acquisio.com

- aaaa.orgwww.roku.com

- prnewswire.com

- thetradedesk.com

- IAB – Advanced TV Webinar July20-23

- Insider-Intelligence

- Media Technology Monitor