By Alizeh Rasool

We are currently witnessing a fundamental shift in the television viewing patterns and content preferences of Canadians. With the great advancements in video streaming technology, Canadians of all ages have changed how they are viewing both television and consuming all other forms of entertainment. Recent Vividata research indicates that 94% of Canadians have watched some form of video content online. The same study found that 64% of people said “yes” to personally streaming videos/TV online and 53% have watched it through SVOD services.

According to eMarketer, 63% of Canadian households already own a CTV device and ownership is increasing at an unimaginable pace. Since COVID (March 2020) there has been a 200% increase in CTV consumption.

It is estimated that Connected TV households globally will grow to 82% by 2023. With the prevalence of the internet and its ability to extract consumer behaviour data, advertising now cements a key position within the Connected TV (CTV) universe as an effective advertising strategy for marketers.

Understanding Connected TV

CTVs include Smart TVs as well as traditional TV sets that can be connected to internet-based consoles such as a Blu-ray player or Xbox.

Connected TV functions using an OTT (Over the Top) based service, internet being the basic ingredient. Many confuse CTV and OTTs to be substitutes for each other however CTV is the screen/device that is connected to the internet, whereas the OTT is the content channel that is displayed via CTV. More easily put, CTV is the hardware and OTT is the software.

The umbrella term for this new technology is Advanced TV or Non-traditional TV. Today in a globalized and more connected world, where consumers are demanding more focused and message driven ads, CTVs provide advertisers with a plethora of benefits and a much better data driven approach to reach their audiences.

CTV has been highly successful over the past few years for both viewers and advertisers. So much so that it is expected to cross the number of Linear TVs within next 5 years. Many larger traditional TV advertisers have already increased their spending on it.

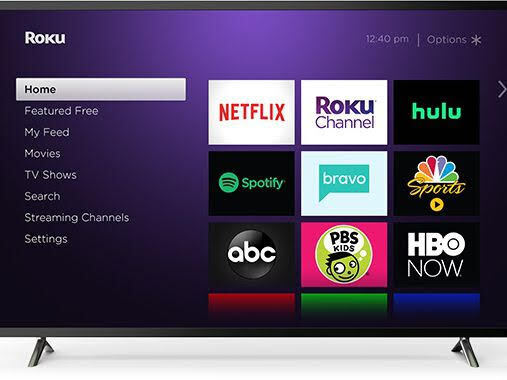

In Canada there are several key players in the Connected TV space. One such player is Roku. Roku TV offers smart TV with a simple home screen and easy to use remote that supports major OTT services, allowing its customers to get a full Connected TV experience. Also, Roku has its own streaming platform that enables content providers and advertisers to connect to large and highly engaged audience.

Samsung Smart TV has also emerged as a key manufacturer in providing CTVs in Canada. About 47% of the Samsung Smart TVs tune-in to both linear TV as well as use a Smart TV app. Also, more than half of all TV viewing minutes are through Samsung Smart TVs.

OTT and its role

Over-the-Top refers to video content that is viewed on a CTV using an app or a website with a variety of customizations available to the viewer. Examples include Netflix, Roku, Amazon Prime, Crave, Tubi, DAZN etc. These platforms cover a large portion of Canada. There currently about 25 OTT services in Canada and much higher growth of these services is anticipated in the next few years.

OTTs have played a major role in the maturing of CTV advertising in Canada. The number of subscriptions on OTT platforms in Canada has seen a rise in the past few years taking it to 20.1 million subscriptions in 2020. Much of this increase can be attributed to COVID. The number of Canadians who subscribe to at least three or more over the top (OTT) services has grown by 58% since March 2020.

How does CTV/OTT advertising work?

Program content on OTT services is delivered via an internet connection rather than through a traditional cable/broadcast provider. Content can be accessed anywhere and anytime through the vast range of connected TV products therefore allowing marketers to show targeted ads only when the viewer is actively watching. This creates highly effective targeting, and like other digital media advertising platforms, can produce significant ROI for advertisers.

Ad space is purchased on OTT/AVOD (Ad-Supported Video on Demand) platforms primarily in 15 or 30 second ad units. Some OTTs like ROKU also offer overlays and sponsorships. Ads are usually displayed either at the beginning and during the program. In many cases they are non-skippable in order to make consumers watch them in full.

Connected TV advertising can primarily be purchased in 3 ways:

- Directly from Publishers/Broadcasters- Advertisers work directly with the content producers and broadcasters to and buy the ad space. eg. Rogers, Corus, CBC, Quebecor

- Platform aggregators- Platform aggregators that attempt to add value through first party data overlays, including automatic content recognition from various sources. eg. Samsung, Roku

- Programmatic media buying- Automated technology utilizes data insights and algorithms to serve ads to the right user at the right time. eg. DSPs like Google’s DV 360, StackAdapt, The Trading Desk

Benefits of CTV/OTT Advertising

There are numerous benefits to CTV/OTT advertising that suggest the time is now for marketers and agencies to include it in their communication plans. With 23 million Canadians watching online TV in an average month, CTV can provide high reach and targeted ad placement both individually and geographically. There is nowhere to go but up. Currently OTTs’ top users’ younger viewers but it won’t be long until all age groups catch up. OTT technology will continue to evolve as more people discover the incredible choices they have on smart devices and turn off their TVs.

CTV ads are much more precise and delivered according to viewer’s interests and consistently provide much better cost to output ratio.

The data and insights captured by CTV ads can be analyzed in real-time leading to faster and better optimization of consumer preferences.

Some of the Barriers

With every new technology come a few concerns that need to be addressed to make the platform better. There are several challenges in CTV/OTT, some are new and some of these we already face in the digital advertising industry.

Unique to CTV:

- Lack of standard definitions

- Lack of universal measurement

- Significant limitations for controlling frequency

- Education of marketers about the platform

Challenges shared with all digital advertising

- Viewability

- Brand safety

- Transparency

- Fraud

Significant measures have been taken by the industry over the past few years to ensure that there is less fraud and better transparency and brand safety. This is via verification providers, accreditations, and ongoing monitoring and audits.

Conclusion

It is time for advertisers and marketers to take advantage of this incredible opportunity as it reaches maturity. Yes, there are challenges and barriers, but there is also no doubt that the industry will find solutions to make CTV a successful operation.

An added benefit for Canada and its audiences is that CTV is currently in its infancy. This implies that there are only a few players currently in the field, leading to immense opportunities for the new ones who enter. Also due to the limited number of Canadian broadcasters, compared to US and other countries, the infrastructure and inventory implementation and management seems a bit easier task. This will undoubtedly help the players build a better relationship between the stakeholders of Connected TV.

Estimates suggest that US advertisers will spend $6.94 billion on CTV ads this year and will grow to $14.12 billion by 2023, leaving no doubt that CTVs are the future of advertising.

Sources

-

- www.acquisio.com

- www.aaaa.org

- www.roku.com

- www.prnewswire.com

- www.thetradedesk.com

- IAB – Advanced TV Webinar July20-23

- Insider-Intelligence

- Vividata

- Media Technology Monitor